H & R Block

Description

H & R Block will help you with your taxes, finances, bookkeeping, and payroll. They are available online and in person.

H & R Block offers help with taxes to business owners such as self-employed and small businesses. Their small business-certified tax pros have up-to-date information on federal, state, and local taxes. They are available year-round, have specialized training in small business taxes, and have an average of 12 years of experience.

For self-employed, they offer help with Form 1040 and Schedule C, Form 1120S for S Corporations, Form 1120 for C Corporation, and Form 1065 for Partnerships.

H & R Block offers full-service bookkeeping services. This includes a dedicated account manager, quarterly support with on-demand access to expert help, and a review of your books year-to-date. Also, you will get access to virtual and in-person help, an action plan created each quarter, on-demand access to Xero, and onboarding to Xero.

H & R Block will provide you assistance in setting up a consolidated view of all your accounts, monthly reconciliation, financial statement creation & delivery, real-time transaction categorization, and ensure that the books would be finalized for tax time.

Payroll services provided by H & R Block include a dedicated account manager and set-up support on their platform. Also, they provide fully compliant payroll runs for federal, state, and local requirements. Other services include federal & state tax withholding/remittance, W-2 creation & distribution, quarterly payroll filling (Forms 940/941), quarterly unemployment withholding, and much more.

H & R Block also offers personalized consultations that will help you to navigate your tax situation. They will cover such topics as underutilized deductions that can help to lower your tax liability, general tax education, common payroll tax issues, and how to organize your financials to track your business expenses.

Photo

Services

$50 Bookkeeping Starter

Do your own bookkeeping with our on-demand support along the way. Guidance from a dedicated point person to keep you on track Full, on-demand access to Xero* — an online accounting software Action plan created each quarter with specific recommendations

$150 Bookkeeping Full-service

Our professionals will take bookkeeping off your plate to help give you time back. Dedicated account manager to handle all paperwork on your behalf Monthly reconciliation delivered to your inbox Books done by tax time with 100% accuracy guaranteed

Business

Get back to business! Need to reach your account manager? Connect over the phone, video, or in person

$59 Payroll Self-Employed

Stay compliant with the help of our payroll services for small business. We make it simple to hand off year-end tax filings and payroll processes.

$79 Payroll One+ Employees

Stay compliant, pay employees on time, and get help when you need it. Assurance your team is paid on time while you focus on doing what you love Run payroll multiple times for all employees Allow employees access to W-2s and paystubs

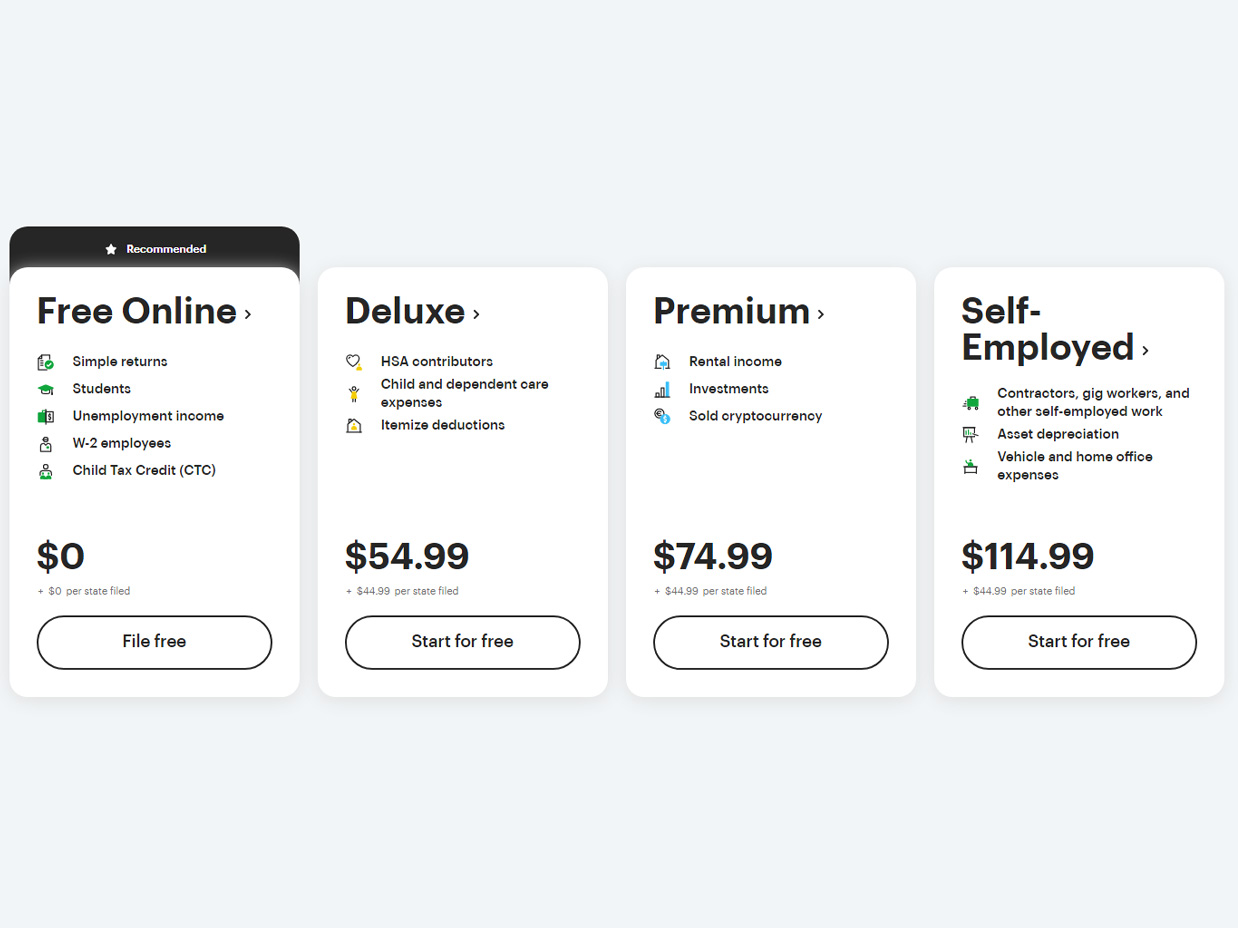

$29.95 Tax Basic

H&R Block gives you the power to score your max refund with the tax preparation process you want. Enjoy drag-and-drop imports, and photo uploads. When you only need to file a simple federal tax return, Basic is for you.

$54.95 Tax Deluxe

H&R Block’s Deluxe + State tax software has everything you need to maximize your deductions as a homeowner or investor. Enjoy the benefits of Deluxe, while filing your state return, too.

$74.95 Tax Premium

H&R Block’s premium tax preparation software has the right tools if you’re self-employed, a freelancer, an independent contractor, or a rental property owner.

$89.95 Tax Professional

We designed this small business tax software so that you’d have everything you need to file federal, state, and business taxes easily, accurately, and on time.

Harry Melling

My experience from working with these specialists is not bad at all, and I’m glad that I didn’t have to worry about keeping track of their work to make sure that they’re actually worth the money. I could see the beneficial changes, and now I’m thinking about the contract extension.

November 29, 2022

Ostin

That’s actually a great company to work with if you run a small business and have some issues with taxation, but for medium or large companies, it’s not going to work, you just need to keep that in mind. Overall experience is pretty good, and I’d definitely continue working with them if I didn’t want to expand my company.

December 1, 2022